📝 Interview with Manas Human | CEO of Nagarro.

"While we fight the battles month to month, we have to keep an eye on the long term."

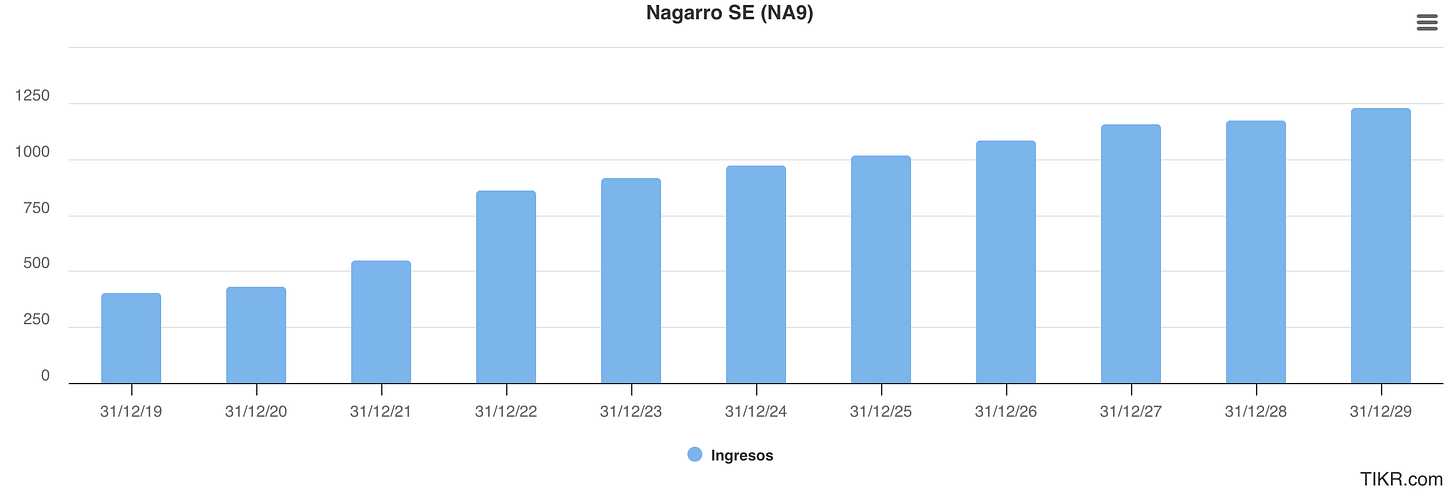

📈 Nagarro’s Journey Since Its IPO

Today, I have the honor of sharing an interview with Manas Human, CEO of Nagarro. I want to sincerely thank him for his generosity in taking the time to conduct this interview and for answering the questions in detail.

Nagarro is a well-known IT services and software development company within the retail investor community. It went public at the end of 2020 following a spin-off from its parent company, Allgeier SE.

Since then, its revenue has grown from €430 million in 2020 to €972 million in the recently reported 2024 financials — representing a +126% increase in revenue.

The same trend can be seen in earnings per share, which have nearly doubled from €2.16 in 2020 to €4.14 in 2024.

In 2025, during the recent earnings presentation on May 15, Manas himself reaffirmed the guidance initially provided earlier in the year was still valid. Hitting that guidance would imply organic revenue growth between +5% and +11%, along with up to 100 basis points of EBITDA margin expansion.

Despite the strong business growth achieved in under five years and solid prospects for 2025, the stock is currently trading below its closing price on the first day post spin-off, which was around €84.73 (it opened that day at €69). Today, shares trade in the €58–60 range, implying a negative CAGR of roughly 6–7% or a total return of -27–28% over the four and a half years since listing.

⭐ 10 Key Questions with CEO Manas Human

Given these data points and where Nagarro currently stands in its growth journey, I felt it was both necessary and timely to ask the company a series of key questions — and who better to answer them than the CEO himself, Manas Human.

⭐ Specifically, these are 10 key questions that, in my view, every Nagarro investor would like to have answered. They will also be valuable for anyone considering an investment in the stock or with exposure to the IT services sector.

Why is Nagarro maintaining its guidance while most peers are lowering theirs — is it realistic? What impact is AI having on the business? What truly differentiates Nagarro? What are its growth levers? Why isn’t the company pursuing more aggressive share buybacks? Why did Carl Georg Dürschmidt return after announcing his departure? And finally, is a potential U.S. listing on the table?

✅ Coming Soon on Quality Value:

👉 You’ll find all of the above — and much more — in the following interview. But before we dive in, here’s a quick look at some of the upcoming articles:👇

Personal Portfolio Update ➡️ June 7

14 High-Quality Swedish Microcaps ➡️ June 14

Teleperformance Capital Markets Day Analysis ➡️ June 21

New High-Quality & Undervalued Idea: Growing at +44%, Trading at 9.5x P/E ➡️ June 28

New High-Quality & Undervalued Idea: A Compounder Actively Buying Back Shares ➡️ July 5

✅ If you’re looking for actionable investment ideas — companies that are both high-quality and attractively valued — this is the newsletter for you. By subscribing, you’ll also gain access to my personal portfolio and receive real-time alerts on every move I make.

👉 Without further ado, here is the full interview with Manas Human, CEO of Nagarro. I hope you enjoy it and find it valuable.👇

📝 Interview by: Alejandro from Quality Value

👉 Answered by: Manas Human – CEO of Nagarro

1. I would like to begin by discussing the most recent results presented on May 15th. You reiterated your full-year 2025 guidance, which calls for organic revenue growth in the range of 5–11%, along with stable or slightly improved EBITDA margins—potentially up by 100 basis points. Meanwhile, peers such as Endava and Globant have mentioned that while demand appears to be picking up, they are experiencing challenges converting it into signed deals, resulting in what they have referred to as an "air pocket" that could persist into 2026. In your view, what differentiates Nagarro in this context—what is the company doing differently that allows you to maintain your guidance and continue signing new contracts in contrast to some of your peers?

We did not see the need to make any changes to our existing guidance. Our guidance reflects our expectations for our business within the current macroeconomic environment. And we remain focused on our own business context rather than drawing comparisons with peers.

Even within our business context, our focus is on our clients, who appreciate our agility in responding to their needs and our ability to solve tough engineering problems for them. We are well-diversified across industries, geographies, technologies and solutions, and we are able to use our experiences, stories and testimonials to connect the dots for our clients and deliver them value. So when our clients will spend, they will spend with us.

About 4/5ths of our business comes from existing clients, where we work on multi-year strategic initiatives. We tend to grow from project to project, then from a project in one division to the next division, and then to other divisions in another country, and to other lines of business within the same group. We also win business via referrals and recommendations from our existing customers, and referrals from partners such as the big consultancy firms. We grow through acquisitions, and our M&A has of late looked for access to large global clients. And finally, our dedicated global sales force hunts and lands new logos worldwide quite effectively. This is how we have done things for a long time.

But we also have some new strategies. We are still a small company as compared to the larger market, and a smaller company should be able outgrow the market significantly, and it is now our intent to do exactly that. Partnerships such as the ones announced with Marubeni in Japan, or with Advantech in Taiwan, can open doors to many more new clients. We also have a great partnership with Siemens, where we not only “sell to the client” but also “sell with the client”.

We will have more such valuable partnerships in the coming months.

2. The guidance you’ve provided appears to be entirely organic and does not include the contribution from recent acquisitions, such as Notion Edge. During your call, you mentioned that M&A remains a strategic pillar of Nagarro’s growth agenda. Would it be possible to share any additional insights or estimates regarding your expected top-line growth when factoring in both organic and inorganic components for 2025?

As a tradition, our guidance never includes contributions from M&A because the exact timing and size of deals is difficult to predict. By the way, Notion Edge was a fairly small acquisition and doesn’t really move the revenue needle this year. We are still very excited about the capabilities it brings to us. We have been working with the Notion Edge team for a while even before the deal.

3. Globant recently introduced a new commercial model based on a subscription offering powered by AI. Is Nagarro exploring a similar path? More broadly, how is the company approaching the challenges and transformative impact of artificial intelligence on the IT services and digital engineering space?

AI is like electricity. It is powering everything we do. There are many, many types of commercial offerings that are being powered by AI. There are many types of industry transformations that will be driven by AI. It’s a bonanza for engineers!

This is a future we at Nagarro have been awaiting. Even in our spinoff roadshows, back in 2020, we had talked how “software would become easier to write” and how our philosophy of small, agile teams was designed to address that. Well, AI is finally here, and we are prepared.

Fluidic Enterprise is our overarching theme for AI. It encompasses how AI can drive efficiency, responsiveness, intimacy, creativity and sustainability for our clients. The details vary from industry to industry, from function to function. We are also rolling out the same theme internally, trying to be even more fluidic than we have always been. Nearly every internal process is impacted with AI, our software development life cycle is transforming, our technology and consulting offerings are expanding, and our ambitions are growing. You may also have heard about our recent partnership with Taiwan’s Advantech, to develop special Edge AI use cases, especially for real-time, low-latency, efficient, or high-privacy contexts.

With AI, we feel superhuman, and although there is a lot of work to do, the opportunities are massive.

4. One of the key highlights from your most recent earnings call was the emphasis on three distinct growth levers: 1) entering the Japanese market, 2) deepening your footprint within the German Mittelstand segment, and 3) the strategic alliance with Advantech. You mentioned that each initiative has the potential to generate up to €100 million in new business, for a combined total of €300 million. Could you kindly provide more clarity on the expected timeline for these opportunities to begin translating into tangible results on the P&L?

All three growth levers are in early stages of maturity and have different timelines. For Japan, we have already been doing some business with Japanese clients for a few years, so we have a base. But this year, we are firing it up. We have created a GBU focused on Japan, and nominated a very smart and experienced Japanese person to lead the GBU. We also have a COE for Japan, to help the other GBUs penetrate the market. Meanwhile, we are looking for one or two key strategic partnerships in the country.

In the German Mittelstand also, we already have a base. Several German Mittlestand companies are existing clients of Nagarro, mostly for our SAP GBU. A new “Hidden Champions“ GBU has been created to showcase the full suite of Nagarro’s technology offerings to the Mittlestand clients.

Our latest partnership with Advantech holds a lot of promise in edge AI and IoT solutions. This is a new area for Nagarro so it may take relatively more time to develop compared to the first two initiatives. But it is equally exciting.

To answer your question: I think each of the new initiatives may contribute a couple of million of revenue this year, but in 2026 we could be touching double digits in each, and then the acceleration should truly start.

5. The broader IT services market has remained somewhat muted since 2022, with considerable uncertainty around the long-term impact of AI on business models and workforce needs. From your perspective, where do we currently stand? Are you observing signs of a recovery in underlying demand? And how do you assess the view, held by some analysts, that AI could lead to a structural reduction in the need for software developers due to increased automation?

At least in the space of digital engineering for non-ISV companies, which is our main market, the primary effect we have been seeing has not been on the supply side but on the demand side. There has been caution created by the new AI technologies, which are seen as promising but also tricky. Then you had the overhang of big digital spends in 2021 and 2022. Therefore CIOs and CDOs have been cautious. I think that as soon as we start to have some mature lighthouse examples of AI-driven transformations in different industries, we will see a return of spend.

AI will definitely make each developer more productive. But this is not new. Technology has been making developers more productive for decades. Our industry will continue to evolve but we do not see the work going away.

6. I would now like to touch on Nagarro’s capital allocation strategy. Some market participants have raised concerns regarding the recent introduction of a dividend policy, arguing that—given the current valuation of the stock—available capital might be better utilized for share repurchases, potentially through a tender offer. How would you respond to those views?

Buybacks are indeed a useful tool, especially during periods where the market value of our company is at a significant departure from our intrinsic value. Consequently, we announced a buyback which began on Feb 5 and have reported our buyback progress through May 22. Our sustainable dividend policy with our announced dividend of €1 per share represents a relatively small capital commitment of ~€13mn. But it comes with a much stronger signaling – that we are comfortable with our cash flow generation in the future. We were also mindful of attracting dividend-seeking investors to widen our existing investor base. Further, due consideration was given towards providing a small yield to our large and loyal retail investor base.

7. On the topic of share buybacks, Nagarro recently announced a significant €400 million repurchase program. While many investors welcomed the initiative, some analysts have questioned the feasibility of executing it within a reasonable timeframe given the company’s current free cash flow generation, dividend commitments, and existing debt repayments. In the last quarter, €22 million were allocated to buybacks; maintaining this pace would imply that the program could take more than four years to complete. Are there any considerations to potentially accelerate the buyback pace while the stock remains at depressed levels?

As of May 22, 2025, we have concluded our 2025 share buyback program and the current authorization given by the AGM 2020 was reached. We purchased 684k shares or nearly 5% of the outstanding shares for ~€50m. Given our healthy cash flow generation, limited annual dividend commitment, and low levels of net debt leverage, we are quite confident that in the permitted time of 3 years, we will be able to do a substantial buyback of up to €400m. Depending upon the share price evolution, we may not be able to spend the entire amount, but we surely expect to have the ability to do so.

We will seek a further approval related to the program at our AGM in June, and consider buying back more shares in the coming quarters.

8. Another notable development has been the recent changes to your Supervisory Board, with the addition of Martin Enderle, Hans-Paul Bürkner, and Jack Clemons, as well as the unexpected return of Carl Georg Dürschmidt, who had previously announced his departure in March. Could you please elaborate on the reasoning behind these swift and significant changes at the board level?

A. In the short span of <5years of our journey as a listed company, we have always aimed at high standards of corporate governance. Our Supervisory Board had members with a wide range of experience and expertise – Mr. Duerschmidt for finance, entrepreneurship, organizational culture, and M&A; Mr. Bacherl for financial audit, capital markets and corporate finance, Mrs. Sarin for organizational behaviour, human resource and sustainability topics, and Prof. Dr. Vishal Gaur for technology, operations and business insights. And it has been our constant endeavour to expand the Board by inducting eminent persons who appreciate the unique structure of our business and are willing to join us in taking Nagarro to the next level.

The recent additions to the Board are all accomplished individuals. We welcome them and we are excited about the impact we expect them to make in the coming days.

Mr Duerschmidt had expressed his desire to step down as Chairperson of the Board for personal reasons, but he is quite happy to be a part of Nagarro as Board member. We welcome him back and look forward to his continued guidance.

9. Nagarro also recently appointed KPMG as its new auditor, which could be interpreted as a step toward enhanced governance and transparency—potentially in preparation for a U.S. listing. Is such a listing under consideration, and if so, could you provide any indication of the expected timeline or milestones?

During our spinoff in 2020, we had mentioned to investors that in due course, we would look to appoint a Big 4 auditor. Consequently, KPMG was appointed as our auditor for FY2024 and we are very pleased to report that the first full audit of Nagarro SE by a Big 4 auditor concluded successfully.

While we don’t expect a US listing in the near term, it remains one of an array of strategic possibilities for Nagarro in the future.

10. To conclude, many of the readers and subscribers of this interview are Nagarro shareholders. What key message would you like to share with your investor base at this point in time?

I have been reading “Shoe Dog” by Nike’s Phil Knight. It reminded me of the need to take the long view in the development of a great company. It took Nike about 10 years and a lot of struggles to reach just $10 million in sales. We at Nagarro can relate to that. It took nearly 25 years to cross $1 billion in sales. We can relate to that too! And when we look at today’s Nike, the $50 billion giant, we have to remember it has been around for over 60 years. 60 years!

My takeaway, and my message for our investors is this: while we fight the battles month to month, we have to keep an eye on the long term.

Nagarro is a cutting-edge and innovative company, trusted as a vendor by the world’s greatest companies, and in the long term, it will itself be one of the world’s great companies. Like Nike.